Calculate book value of equipment

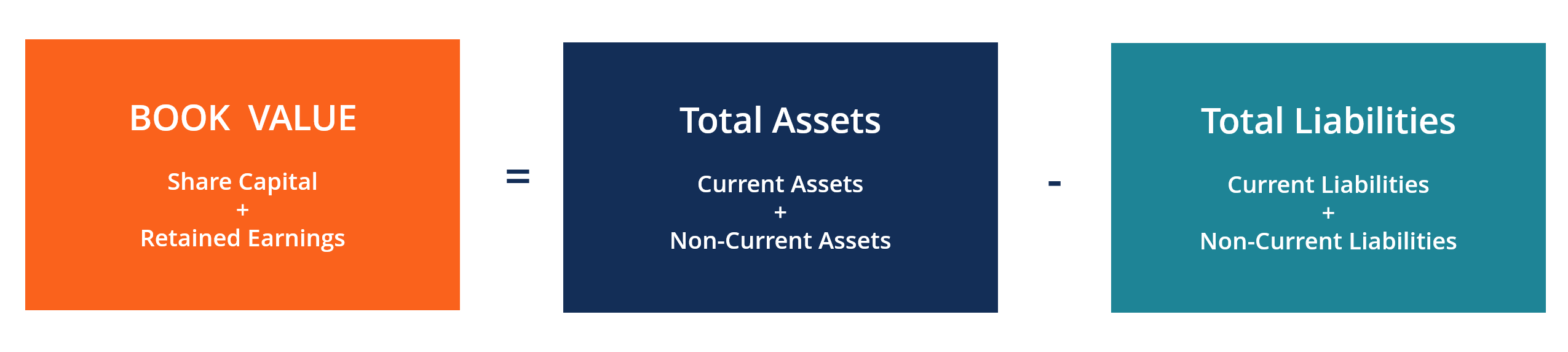

By subtracting the total liabilities from the total assets you find. You calculate book value by totaling every asset a company possesses and every liability that the company holds.

Book Value Definition Importance And The Issue Of Intangibles

Check prices by MAKE MODEL AND YEAR.

. If its heavy machinery equipment Rouse appraises it. Net Book Value Original Asset Cost Accumulated Depreciation. In an empty column type.

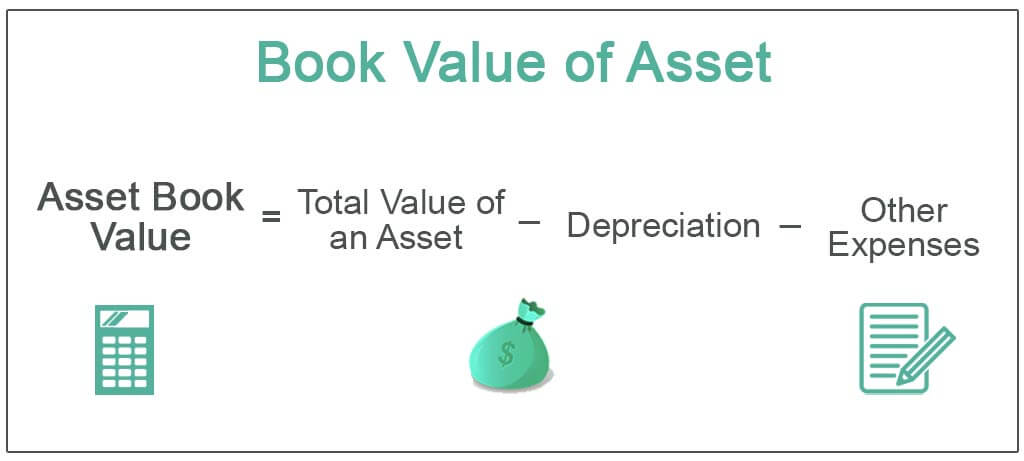

Book Value Assets Original Cost Depreciation Lets say you bought a car. If the logging company purchased the truck for 200000 and the truck depreciated 15000 per year for 4 years the calculation of NBV would look like below. Book value is the net value of assets within a company.

In the UK book value is also. Inform the appraiser that you want to know the items book value on the day of the appointment. Well show you the average.

If you want to calculate book value use this formula. Its a metric used to calculate the valuation of a company based on its assets and liabilities. Here is the book value formula for an individual asset.

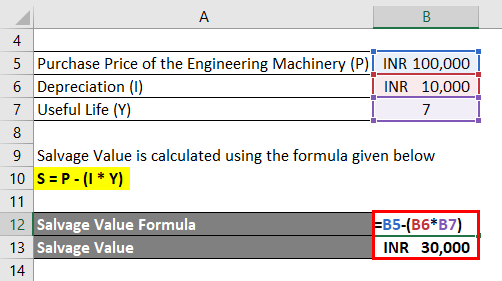

Book value cost value annual depreciation x age For example if your item cost you 20000 five years ago and you depreciate 2000 for it every year its book value would be. The appraiser will view your machine and calculate its value based on. Net Book Value formula Original Purchase Cost Accumulated Depreciation You are free to use this image on your website templates etc Please provide us with an attribution link.

You can calculate the value of your equipment stock by exporting your equipment and making the calculations in Excel or Google Sheets. How do you calculate book value of equipment. Book value is equal to the cost of carrying an asset on a companys balance sheet and firms calculate it netting the asset against its accumulated depreciation.

If the asset is disposed of for more than its book value the seller records. The formula for calculating NBV is as follows. Product Insert in the brackets separated by a comma the Quantity and the New price you want to multiply.

Book value cost value annual depreciation x age For example if five years ago you purchased construction. Book Value Acquisition Cost - Depreciation Back to Equations What is Book Value. You can do this by clicking on the.

Click Items next click on one item Click Depreciation Fill in the items purchase price and its purchase date Fill in the items residual value The items Book value will automatically. Its original cost was 20000 and. Ad Delivering the most accurate appraisals.

Check prices for your. Original purchase price Subsequent additional. Its a quick way to find out the range of listed prices for your search.

The book value or cost of the asset less its accumulated depreciation must be removed from the accounting records. Check prices for your favorite vehicles. Book value is an accounting measure of the net value of a company.

How to Calculate Book Value the book value formula The calculation of book value includes the following factors.

Salvage Value Formula Calculator Excel Template

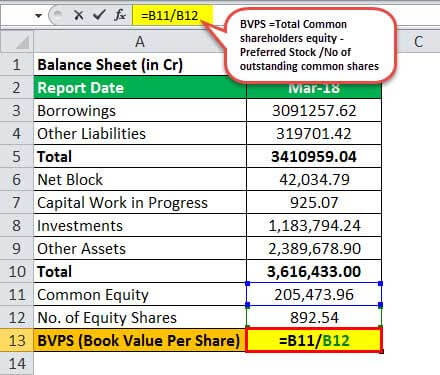

Book Value Per Share Bvps Formula And Ratio Calculator Excel Template

Book Value Per Share Bvps Formula And Ratio Calculator Excel Template

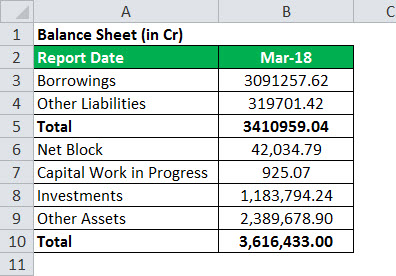

Book Value Of Equity Formula And Calculator Excel Template

Book Value Formula How To Calculate Book Value Of A Company

/ScreenShot2022-03-08at4.53.06PM-eda6eb2099b245129240ed8ef9d984ed.png)

Book Value Vs Market Value What S The Difference

Salvage Value Formula Calculator Excel Template

Disposal Of Fixed Assets Journal Entries Double Entry Bookkeeping

Book Value Of Assets Definition Formula Calculation With Examples

Book Value Formula How To Calculate Book Value Of A Company

Book Vs Market Value Key Differences Formula

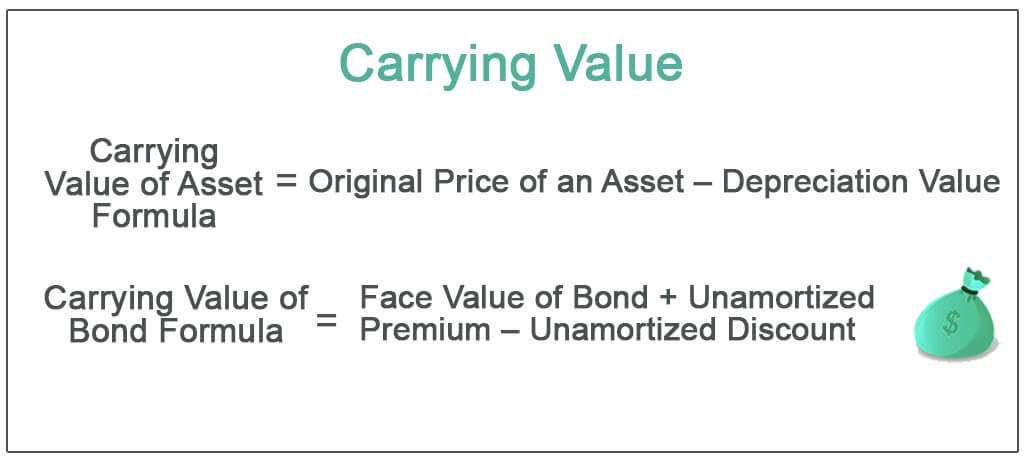

Carrying Value Definition Formula How To Calculate Carrying Value

Net Book Value Meaning Formula Calculate Net Book Value

Book Value Formula How To Calculate Book Value Of A Company

Salvage Value Formula Calculator Excel Template

Straight Line Depreciation Accountingcoach

Book Value Of Equity Formula And Calculator Excel Template